Vera2, White House & Politics

Tariff Threats | Trump Threatens to Impose Additional 100

Trump’s Tariff Threats and Market Reactions

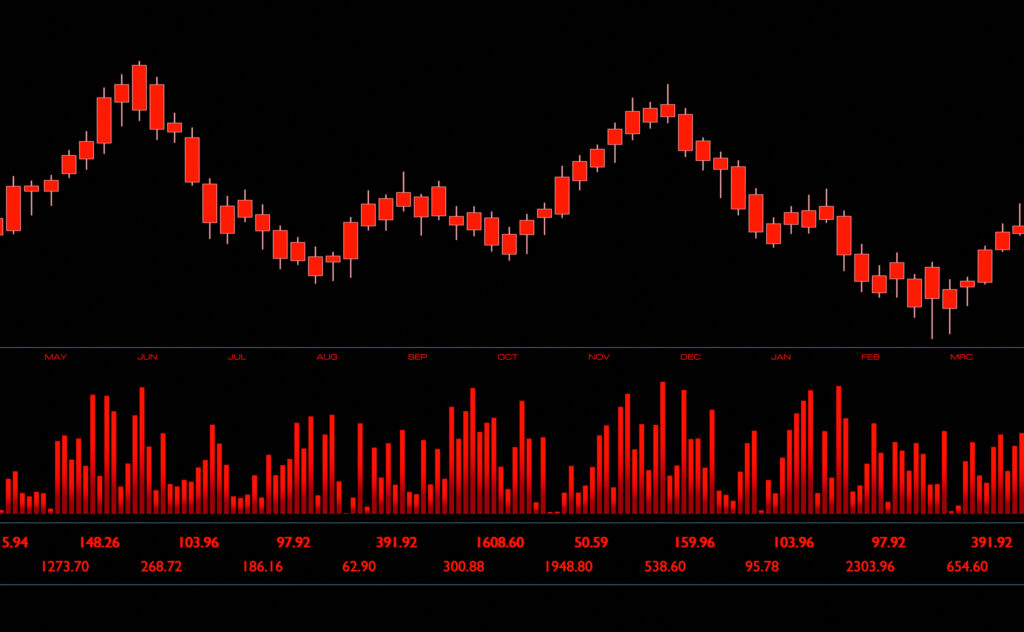

The phrase tariff threats did a lot of heavy lifting on October 10, 2025. Within hours of President Donald Trump floating a potential 100% levy on Chinese imports, U.S. equities logged their sharpest one-day selloff since April, with the S&P 500 down 2.7%, the Nasdaq off roughly 3.6%, and the Dow sliding 1.9%. Bond yields fell as investors sought safety, gold firmed, and risk appetite evaporated—classic hallmarks of a shock to policy expectations. Markets have still been digesting whether these tariff threats are a negotiating gambit or the opening move in a new trade confrontation with China after months of relative calm.

What moved the market

The proximate catalyst was Trump’s fresh tariff threats, delivered alongside criticism of Beijing’s export controls on critical minerals and hints he could cancel a meeting with China’s leadership. Traders immediately priced in higher supply chain frictions, margin compression in import-heavy industries, and a potential demand hit if consumers face faster price increases on everyday goods. The selloff was broad but sharper in tech and semiconductors, which tend to be most exposed to China for both inputs and end-market demand; several marquee chip names dropped between 4% and 6% on the day. The S&P 500’s 2.7% decline marked its worst session since April and erased its weekly gains, reinforcing how quickly tariff threats can overwhelm otherwise constructive macro narratives.

A quick look at cross-assets added context. Treasury yields retreated as investors rotated into duration; gold hovered near cycle highs; and crude extended losses as traders marked down the global growth outlook. The combination signaled a classic flight-to-quality amid policy uncertainty. That pattern has repeated in prior episodes when tariff threats escalated into concrete measures, which is why desks moved to reduce cyclical exposure and trim high-beta names first.

How tariff threats transmit to earnings and growth

Tariff threats matter because they change the arithmetic for costs, pricing, and confidence. If a 100% tariff were imposed, importers would either absorb some costs (squeezing margins) or pass them through (risking demand). Many U.S. firms source components from China or assemble finished goods there; the immediate question for analysts is how quickly supply chains can be re-routed, at what premium, and with what level of execution risk. History is instructive: the 2018–2019 U.S.–China tariff cycle showed that sustained tariffs raised input costs and forced firms to reconfigure logistics, with the macro effect tilting disinflationary or inflationary depending on pass-through and Fed stance. Brookings’ post-mortem found more pain than gain for the U.S. overall, especially when retaliatory levies hit American exporters. That legacy explains why the market responded forcefully to the latest tariff threats.

At a macro level, tariff threats can depress capex because planning horizons shorten. CFOs often pause factory upgrades or green-field projects if forward price structures and market access are in flux. Consumer confidence can wobble if headlines imply broad price hikes ahead. Those dynamics do not require tariffs to be enacted; tariff threats alone can tighten financial conditions by boosting volatility and risk premia, which then feed back into hiring and investment decisions.

What’s new—and what’s familiar—in U.S.–China tensions

What’s new is the scale of the signal: a floated 100% tariff goes well beyond the 2018 menu of 10%–25% tranches and would touch far more consumer-facing categories, from smartphones to apparel. What’s familiar is the playbook: a sharp public threat, quick market repricing, and a subsequent debate over whether the move is leverage for negotiations or a policy objective in itself. Reuters and the Financial Times both reported that Trump’s rhetoric framed China as “very hostile” and pointed to rare-earth curbs, while hinting at scuttling a near-term meeting with Xi—language that markets read as a genuine escalation rather than routine posturing.

The historical baseline also matters. Timelines from the Peterson Institute and earlier Brookings work detail how the 2018–2019 trade war unfolded, which sectors were hit first, and how retaliation landed on U.S. agriculture and manufacturing. Those studies, plus years of earnings calls, taught investors that tariff waves can be staggered, exemptions can proliferate, and uncertainty often lasts longer than headlines suggest. That is why this round of tariff threats quickly translated into lower multiples for globally exposed firms and a premium for defensive balance sheets.

Which sectors are most exposed

Semiconductors and hardware typically react fastest to tariff threats because of their deep China ties. Software and services, less dependent on physical goods trade, often suffer more from multiple compression than from direct cost impacts. Retailers with high China sourcing are vulnerable on gross margin unless they can flex private-label mix, renegotiate with vendors, or accelerate near-shoring. Autos and industrials face component cost risk and potential retaliation risk on U.S. exports. Consumer staples can sometimes act as ballast if pricing power holds and input inflation is manageable, a pattern visible on the day when select staples outperformed as the broader tape fell.

Financials’ sensitivity is more nuanced. Banks dislike volatility spikes if they coincide with tighter primary issuance and slower M&A, but they benefit when rate-cut odds recede or term premia widen. In Friday’s move, lower yields and weaker risk sentiment dominated. Energy’s reaction hinged on growth expectations; as global growth haircuts widened under tariff threats, crude weakened further, pulling down portions of the energy complex despite idiosyncratic supply stories.

Market sentiment and the policy path ahead

Strategists split into two camps. One camp sees tariff threats as a hard-ball opening bid that will be traded back down to a narrower package once Beijing signals concessions, making the selloff a buyable wobble. Another camp argues that the political logic favors escalation, not compromise, and that supply-chain insulation is now a bipartisan priority, meaning tariff threats could harden into multi-year policy. For traders, the distinction dictates positioning: fade the shock if this is theater, or rotate into domestic defensives and reshoring beneficiaries if it is regime change. The immediate tape—largest one-day S&P 500 drop since April, severe underperformance in high-beta tech—implies investors are, at minimum, pricing non-trivial odds that these tariff threats stick.

The White House messaging adds to the ambiguity. Trump’s comments on Truth Social and subsequent press gaggles leaned into grievance language and set a high bar for any “deal,” leaving little room for a quick de-escalation headline. Meanwhile, China’s likely playbook would involve targeted retaliation calibrated to hit politically salient U.S. exports, as in 2018–2019, and potentially new restrictions in strategic inputs like critical minerals. If both sides dig in, tariff threats could evolve into phased measures with rolling effective dates, mirroring past practice.

What investors can watch next

Three signposts will determine whether tariff threats morph into tariffs in fact. First, official documents: watch for Federal Register notices, product-line lists, and implementation timelines; until those hit, markets are trading rhetoric, not rules. Second, calendar signals: any revival or cancellation of high-level U.S.–China meetings will be read as de-escalation or escalation. Third, price behavior in sensitive assets: semis, rare-earth miners, Shanghai-linked logistics, and yuan-sensitive exporters provide real-time tells. A durable rebound in cyclicals would suggest investors view the tariff threats as a bluff; continued leadership in defensives would suggest the opposite.

For corporates, practical steps include mapping product codes to potential tariff lines; stress-testing landed cost scenarios; hedging FX more actively if tariff threats widen policy divergence; and revisiting inventory strategies to avoid being caught between order placement and tariff activation. None of those moves require panic, but they do require speed when policy risk can change bill-of-materials math overnight.

Politics: the domestic calculus of tariff threats

Tariff threats are also campaign messages. They can poll well in swing regions hit by import competition and serve as a vivid proof-point of toughness on China. But they carry downside risks if higher shelf prices, weaker markets, or retaliatory hits to farm and factory exports materialize before the 2026 midterms. That trade-off is why even supportive lawmakers often argue for targeted, time-limited measures tied to specific negotiating objectives rather than sweeping, across-the-board increases. Public opinion remains mixed: a substantial share of voters likes the symbolism of tariff threats but dislikes paying more at the register for consumer tech, apparel, and household goods. The market’s swift reaction shows how thin the margin for error can be when politics and pricing collide.

Bottom line

October 10 reminded investors that tariff threats are not just words; they are scenarios that cash-flow models must contemplate. Whether this selloff proves a blip or the beginning of a more durable regime depends on the path from rhetoric to regulation. For now, the combination of a 2.7% S&P 500 drop, leadership from defensives, and a swift bid for havens says the market is treating the tariff threats as a credible shock to earnings and growth. Until policymakers outline clearer contours—scope, timing, and carve-outs—volatility around U.S.–China headlines is likely to stay elevated.

Further Reading

AP market wrap on the S&P 500’s worst day since April and the catalyst from new tariff signals: https://apnews.com/article/8898351a46c9aa24cf00313138746e19

Financial Times rundown of the selloff, safe-haven flows, and context for the renewed tariff threats: https://www.ft.com/content/b9ae2417-2e89-4b0a-bad5-d94f4e980ecc

Investopedia session recap highlighting sector moves and notable decliners after the tariff threats: https://www.investopedia.com/s-and-p-500-gains-and-losses-today-index-plunges-as-trump-threatens-hiking-tariffs-on-china-11827984

Reuters on the market move and the explicit sizing of the declines across major indexes: https://www.reuters.com/business/us-stock-index-futures-tick-up-ahead-consumer-sentiment-data-2025-10-10/

Reuters on Trump’s new rhetoric and potential meeting cancellation, plus the China minerals angle: https://www.reuters.com/world/china/trump-says-weighing-massive-increase-tariffs-chinese-imports-no-reason-meet-with-2025-10-10/

Brookings summary of the economic impact from the 2018–2019 trade war, useful context for today’s tariff threats: https://www.brookings.edu/articles/more-pain-than-gain-how-the-us-china-trade-war-hurt-america/

PIIE’s timeline and explainer pages for prior U.S.–China tariff rounds and their macro effects: https://www.piie.com/blogs/trade-and-investment-policy-watch/2018/trumps-trade-war-timeline-date-guide

Connect with the Author

Curious about the inspiration behind The Unmaking of America or want to follow the latest news and insights from J.T. Mercer? Dive deeper and stay connected through the links below—then explore Vera2 for sharp, timely reporting.

About the Author

Discover more about J.T. Mercer’s background, writing journey, and the real-world events that inspired The Unmaking of America. Learn what drives the storytelling and how this trilogy came to life.

[Learn more about J.T. Mercer]

NRP Dispatch Blog

Stay informed with the NRP Dispatch blog, where you’ll find author updates, behind-the-scenes commentary, and thought-provoking articles on current events, democracy, and the writing process.

[Read the NRP Dispatch]

Vera2 — News & Analysis

Looking for the latest reporting, explainers, and investigative pieces? Visit Vera2, North River Publications’ news and analysis hub. Vera2 covers politics, civil society, global affairs, courts, technology, and more—curated with context and built for readers who want clarity over noise.

[Explore Vera2]

Whether you’re interested in the creative process, want to engage with fellow readers, or simply want the latest updates, these resources are the best way to stay in touch with the world of The Unmaking of America—and with the broader news ecosystem at Vera2.

Free Chapter

Begin reading The Unmaking of America today and experience a story that asks: What remains when the rules are gone, and who will stand up when it matters most? Join the Fall of America mailing list below to receive the first chapter of The Unmaking of America for free and stay connected for updates, bonus material, and author news.